SPDR GOLD (GLD)

278.46

+1.21 (0.44%)

| Previous Close | 277.25 |

|---|---|

| Open | 278.78 |

| Day's Range | 278.27 - 279.96 |

| 52 Week Range | 200.96 - 281.48 |

| Volume | 4,511,720 |

| Market Cap | 87.35B |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 8,751,430 |

News & Press Releases

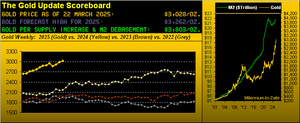

Last week, the gold market saw notable activity, with prices fluctuating from $3,000 per ounce earlier in the week to a high of $3,048 on March 19.

Via Talk Markets · March 25, 2025

Gold has been pulling back after reaching a fresh record high on March 20, 2025.

Via Talk Markets · March 25, 2025

Gold prices rose, driven by concerns over US tariffs, potential recession, and expectations of Fed rate cuts.

Via Talk Markets · March 25, 2025

Fed member Bostic has expressed his contrary belief the Fed will cut rates only once in 2025, giving the greenback a small hawkish tilt and a bullish tailwind.

Via Talk Markets · March 25, 2025

US markets closed higher on Monday, led by tech stocks. Economic data showed growth, but concerns remain over tariffs. Asian markets mostly up.

Via Benzinga · March 25, 2025

Gold price (XAU/USD) attracts some dip-buyers during the Asian session on Tuesday and for now, seems to have snapped a three-day losing streak.

Via Talk Markets · March 25, 2025

Today you will see Gold price predictions based on technical analysis. What is the support and resistance on the daily time frame for XAUUSD?

Via Talk Markets · March 25, 2025

Gold and silver suffered some further weakness.

Via Talk Markets · March 24, 2025

This week started off strong as optimism regarding trade policy permeated the market.

Via Talk Markets · March 24, 2025

Gold markets find themselves at a potential inflection point as multiple technical signals across related markets suggest a possible major turning point is near.

Via Talk Markets · March 24, 2025

Gold has been on a tear, smashing records and surging past the $3,000 mark last week, fuelled by strong safe-haven demand and persistent central bank buying.

Via Talk Markets · March 24, 2025

Gold prices remain firmly bullish above $3,000, driven by safe-haven demand, tariff concerns, and expectations of global central bank easing.

Via Talk Markets · March 24, 2025

Trade tensions, Fed shifts, and weakening sentiment create stormy global economy. JPMorgan's Kasman predicts 40% chance of 2025 recession, spurring ETF shifts. Fed's stance and trade policy key factors.

Via Benzinga · March 24, 2025

Gold holds ground above $3,000 after Friday’s decline.

Via Talk Markets · March 24, 2025

U.S. markets closed higher on Friday after Trump signaled flexibility on tariffs and trade talks with China. Stocks in Asia and Europe also rose.

Via Benzinga · March 24, 2025

Gold is red-hot. This gold ETF has outperformed the S&P 500 by a wide margin over the past year.

Via The Motley Fool · March 24, 2025

Silver has been weaker than gold.

Via Talk Markets · March 23, 2025

Gold’s year-over-year trend remains nothing short of amazing.

Via Talk Markets · March 23, 2025

Gold has easily broken through the 3000 mark and has been consolidating just above it for a few days now. The fact that the price did not fall back below it can be interpreted as a sign of strength. But investors outside the US behave differently.

Via Talk Markets · March 23, 2025

Despite the pullback, we have found numerous opportunities which we discuss in this video using technical analysis.

Via Talk Markets · March 23, 2025

The Australian dollar initially rallied during the past week but continues to see the 0.64 level as a very difficult to get above.

Via Talk Markets · March 23, 2025

It’s been a remarkable run to the historic $3,000 level in gold...but it hasn’t been quite as carefree as the charts might show.

Via Talk Markets · March 23, 2025

For the second week in a row, the Nasdaq 100 traded in a sideways pattern. Last week, it fell 2.5% but recovered from a 5.2% decline at one time. This week, the tech-heavy index inched up 0.25 percent to 19754. That gain follows four weekly drops.

Via Talk Markets · March 23, 2025

Gold retreats for second day as traders lock in gains and US Dollar firms. Fed officials adopt cautious tone, indicating no hurry to cut rates due to uncertainty from Trump's tariffs.

Via Talk Markets · March 22, 2025

As the world becomes more unstable and inward-facing, there is a growing surge toward the most timeless and borderless currencies—gold and silver.

Via Talk Markets · March 22, 2025