Currency News

A hawkish Powell failed to lift the dollar yesterday, as the currency market remains heavily focused on risk asset relative performance.

Via Talk Markets · April 17, 2025

Via Talk Markets · April 17, 2025

GBP/JPY may find immediate support at the lower boundary of the symmetrical triangle, located around the 187.50 level.

Via Talk Markets · April 17, 2025

The EUR/GBP cross attracts some sellers to around 0.8590 during the early European trading hours on Thursday.

Via Talk Markets · April 17, 2025

The Japanese Yen (JPY) retains its negative bias through the Asian session on Thursday against a broadly recovering US Dollar (USD) as a generally positive risk tone is seen undermining demand for traditional safe-haven assets.

Via Talk Markets · April 17, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Wednesday, April 16.

Via Talk Markets · April 16, 2025

The EUR/USD pair trades on a flat note near 1.1400 during the early Asian session on Thursday.

Via Talk Markets · April 16, 2025

The GPIF — the world’s largest pension whale — just dropped a geopolitical bombshell, quietly removing China A-shares from its foreign equity benchmark.

Via Talk Markets · April 16, 2025

From a technical perspective, the USD/JPY pair is showing a mixed picture.

Via Talk Markets · April 16, 2025

Stocks slumped today, as the defiance of economic reality for the sake of policy unity falters.

Via Talk Markets · April 16, 2025

The volume has been coming in waves, and today may have just been the start of the next one. If volume is heavy tomorrow, it’s likely because sellers are pushing prices lower.

Via Talk Markets · April 16, 2025

Mexican Peso appreciates 0.58% as USD/MXN dips below 20.00 on sour risk tone, weak US Dollar.

Via Talk Markets · April 16, 2025

AUD/USD trades around the 0.6400 zone, rebounding strongly during Wednesday’s American session.

Via Talk Markets · April 16, 2025

The reprieve from the angst of the trade war lasted a couple of days, but it has returned following Beijing's actions against Boeing and the US requiring Nvidia to get export licenses.

Via Talk Markets · April 16, 2025

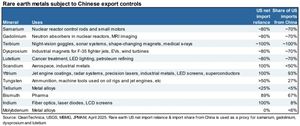

The US has critical rare earth metals. However, extracting and refining those metals face environmental regulations, high costs, and limited infrastructure.

Via Talk Markets · April 16, 2025

The USD/JPY pair extended its decline on Wednesday, dropping to 142.36 amid sustained dollar weakness.

Via Talk Markets · April 16, 2025

Overnight, U.S. markets lost early gains and closed lower as President Trump's ongoing tariff disputes with trading partners kept investors wary despite strong equity reports from major financial firms.

Via Talk Markets · April 16, 2025

Traders should observe the characteristics of wave 3, which often include consistent momentum and direction.

Via Talk Markets · April 16, 2025

The precious metal Gold is rising with very firm bullish momentum to trade at new record highs close to $3,300.

Via Talk Markets · April 16, 2025

FX markets are a little calmer, but traded volatility levels remain elevated.

Via Talk Markets · April 16, 2025

The AUD/USD exchange rate bounced back sharply, continuing a trend that started a few days ago as the US dollar index retreated.

Via Talk Markets · April 16, 2025

The Pound Sterling comes under pressure against its major peers after the release of a soft UK CPI in March.

Via Talk Markets · April 16, 2025

The USD/CAD pair slips slightly after posting gains in the previous session, trading near 1.3940 during Wednesday’s Asian session.

Via Talk Markets · April 16, 2025

GBPUSD has recently broken above its April 3, 2025 peak of 1.3207, which we identified as wave (1) in the chart. This breakout signals a bullish trend starting from the January 13, 2025 low of 1.2705, suggesting more upward movement ahead.

Via Talk Markets · April 16, 2025

The ECB is widely expected to cut rates by another 25bp on 17 April, as growth risks have intensified on the back of US tariffs. The Governing Council may highlight rates are now close to neutral, but that doesn’t rule out further tariff-led cuts.

Via Talk Markets · April 15, 2025