Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

On Friday, Trump Media & Technology Group announced it was raising $2.4 billion from investors to buy Bitcoin.

Via Talk Markets · June 2, 2025

Some bearish bond investors in Japan and the U.S. appear to believe that a paradigm shift is underway in the sovereign bond markets.

Via Talk Markets · June 2, 2025

MSTR stock moved upward throughout June 2, reflecting cautious optimism ahead of the STRD stock launch.

Via Talk Markets · June 2, 2025

The détente—barely warm, let alone cozy—now hangs by a Trump-Xi phone call. And while traders want clarity, they’ll settle for headlines that keep the bid alive.

Via Talk Markets · June 2, 2025

The yen is strengthening against the dollar and the Chinese yuan is in a holding pattern.

Via Talk Markets · June 2, 2025

The first trading day of June was a volatile one, with all three major indexes moving between both sides of the aisle throughout the session.

Via Talk Markets · June 2, 2025

U.S. stock indices ended May in favorable territory as investors found an equilibrium between persistent inflation concerns and anxious corporate earnings.

Via Talk Markets · June 2, 2025

The oil markets had a green day today.

Via Talk Markets · June 2, 2025

EDA software consists of simulation software that predicts circuit behavior, designs solutions that help create the physical circuit elements, and verification systems that ensure the design is correct and manufacturable.

Via Talk Markets · June 2, 2025

The headline number for May declined -0.2 to 48.5, the third straight month of contraction, while the more leading new orders subindex rose +0.4 to 47.6.

Via Talk Markets · June 2, 2025

From a technical perspective, looking at YVWAP - the market was quickly rejected at VWAP upper band, confluence with LVN area.

Via Talk Markets · June 2, 2025

Index providers do far more than supply the benchmarks that index-based products aim to track.

Via Talk Markets · June 2, 2025

Court and stock market actions rendering a verdict on Trump tariffs.

Via Talk Markets · June 2, 2025

Bad news on the tariff front is no longer being perceived as truly threatening, and the “half-life” of each negative piece of tariff news is getting shorter by the day.

Via Talk Markets · June 2, 2025

What began as a movement of early adopters has matured into a full-blown national economic priority, embraced by leaders at the highest levels of government and finance.

Via Talk Markets · June 2, 2025

West Texas Intermediate crude oil edges higher on Monday, kicking off the week on a firmer footing as a weaker US Dollar and persistent geopolitical tensions between Russia and Ukraine continue to underpin market sentiment.

Via Talk Markets · June 2, 2025

US-China trade tensions look set to worsen this week after Beijing on Monday refuted Washington’s claims that it had broken the recent trade agreement negotiated last months.

Via Talk Markets · June 2, 2025

Stocks are looking on the economic bright side these days and have been basically

Via Talk Markets · June 2, 2025

As AI unleashes new revenue streams, stock traders should integrate them in their investment strategies.

Via Talk Markets · June 2, 2025

Natural gas is also turning the corner as hurricane risk rises and we’re starting to move closer to the summer cooling season.

Via Talk Markets · June 2, 2025

July CBOT corn ended weak for the third day – Dec CBOT for a 6th – as the market continues its normal transition focus from old crop to new.

Via Talk Markets · June 2, 2025

The Bank of Canada is expected to hold its benchmark interest rate steady at 2.75% on Wednesday, after growth in the first quarter turned out stronger than many anticipated, reducing the urgency for monetary easing.

Via Talk Markets · June 2, 2025

The month closes higher by 0.60% when it begins in an uptrend like today. However, when January through May show tepid to weak returns, June is down 73% of the time.

Via Talk Markets · June 2, 2025

The FTSE 100 initially declined on Monday as renewed concerns over global trade tensions weighed on market sentiment before recovering late in the day.

Via Talk Markets · June 2, 2025

Markets opened strong as bulls briefly pushed indexes into the green, triggering stop-outs in positions like XOP, COP, and MTDR—only to reverse sharply soon after in a classic intraday whipsaw.

Via Talk Markets · June 2, 2025

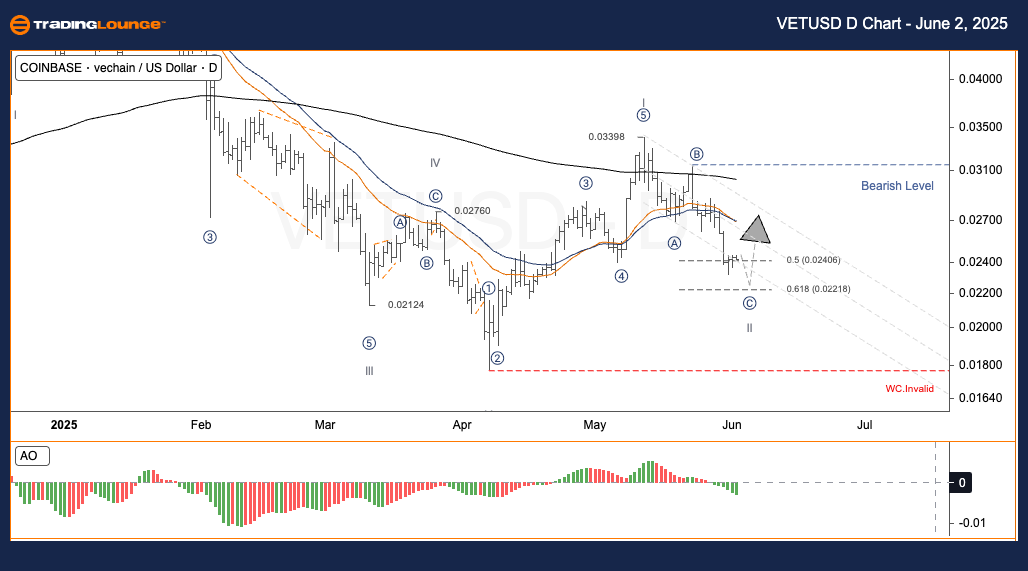

Crypto market is finishing a correction within uptrend, as we see it approaching strong support from technical and Elliott wave perspective.

Via Talk Markets · June 2, 2025

Silver (XAG/USD) is shining brightly on Monday, with prices rallying in response to a weaker US Dollar (USD).

Via Talk Markets · June 2, 2025

Let’s take a look now at construction spending for April. To cut to the chase, in all respects, there was a continued decline.

Via Talk Markets · June 2, 2025

Recent interviews with business leaders reflect the impact of the more uncertain geopolitical environment, both on growth and on costs.

Via Talk Markets · June 2, 2025

The Dow Jones Industrial Average and S&P 500 Index are lower this afternoon, while the Nasdaq Composite Index sits flat, as U.S.-China trade tensions ramp up.

Via Talk Markets · June 2, 2025

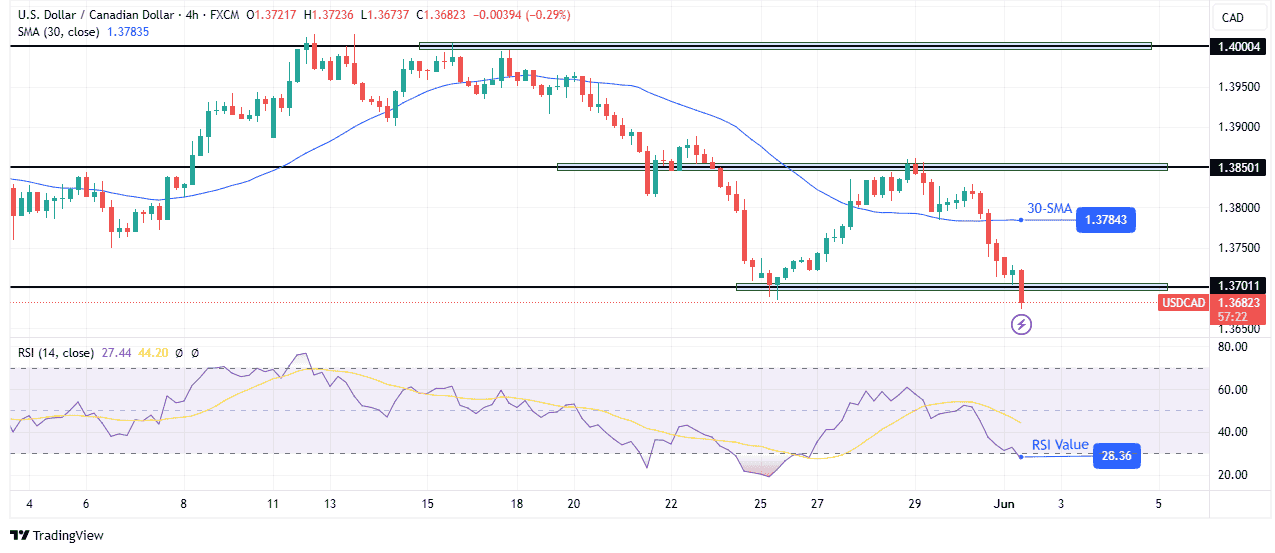

The Canadian Dollar (CAD) extends its winning streak against the US Dollar (USD) for a third consecutive day on Monday, supported by rising oil prices and sustained weakness in the Greenback.

Via Talk Markets · June 2, 2025

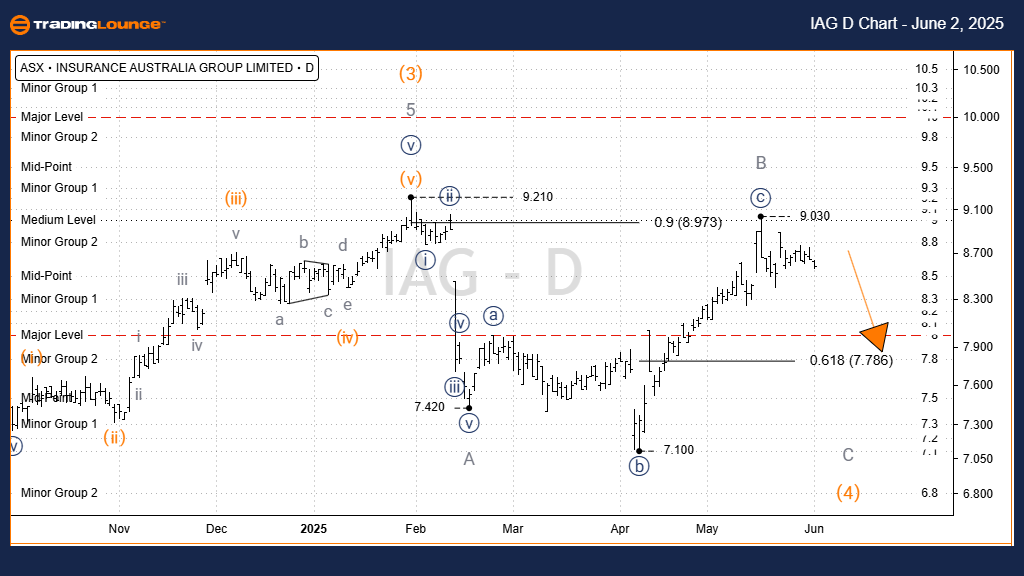

The analysis aims to provide valuable insights into market trends and potential opportunities.

Via Talk Markets · June 2, 2025

AllianceBernstein Holding L.P. (AB) is a publicly owned investment manager. It’s share price rose about 19% over the past year from $33.55 to $39.95 as of Friday’s closing price.

Via Talk Markets · June 2, 2025

A review of the recent price action in the e-mini SP500 futures contract.

Via Talk Markets · June 2, 2025

It was a weekend full of worrying headlines, from escalations on the geopolitical front to negative developments on trade negotiations. Let’s take a look at the updated sector scoreboard…

Via Talk Markets · June 2, 2025

Preparation for today's trading and information on market conditions.

Via Talk Markets · June 2, 2025

First-quarter GDP growth in Poland came in at 3.2% YoY, with visible improvements in the composition.

Via Talk Markets · June 2, 2025

Gold was on the ascendency in the first trading session of June, after ending May flatter than a pancake.

Via Talk Markets · June 2, 2025

The USD/CAD forecast suggests solid bearish sentiment.

Via Talk Markets · June 2, 2025

The breakdown in the US-China trade agreement, the doubling of US steel and aluminum tariffs, and Ukraine's daring drone attack have rattled the market, sending stocks, bonds, and the dollar lower.

Via Talk Markets · June 2, 2025

Amid tariff uncertainty and its possibly adverse implications for inflation and corporate earnings, the major US equity indices, after massive rallies post-April lows, are witnessing sellers come out at/near resistance.

Via Talk Markets · June 2, 2025

The S&P 500 fell 0.8% to close the trading week ending on Friday, 30 May 2025, at 5,911.69.

Via Talk Markets · June 2, 2025

Unlike electric vehicles, which can charge at home or increasingly in public parking lots, hydrogen vehicles depend on specialized high-pressure refueling stations that are costly to build and maintain.

Via Talk Markets · June 2, 2025

Free money includes Medicare, Medicaid, SNAP, Social Security, and more.

Via Talk Markets · June 2, 2025

We expect spot gold prices to rebound higher at the beginning of this week's trading amid ongoing tensions in Russia.

Via Talk Markets · June 2, 2025

Oil prices jumped more than 3% on Monday as OPEC+ agreed to raise production by the same amount in July as in the previous two months.

Via Talk Markets · June 2, 2025

When some innovative Biotechnology players have a string of doing things the right way, well, you would say Cytodyne's past six to twelve months reads like a perfect turnaround in governance, being the first to take away the rest.

Via Talk Markets · June 2, 2025

Buying stocks is always hard. Particularly during corrections. Or, near market peaks.

Via Talk Markets · June 2, 2025

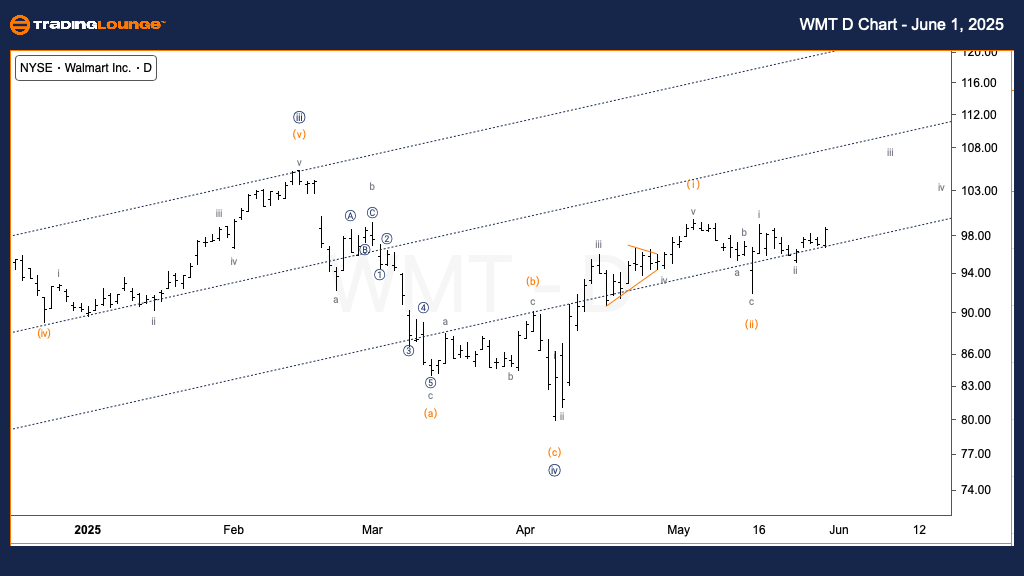

The daily Elliott Wave setup for Walmart suggests the formation of wave (iii) is underway.

Via Talk Markets · June 2, 2025

The USD/JPY pair fell to 143.58, marking its third consecutive day of losses. The Japanese yen continues to gain ground as demand for safe-haven assets rises amid escalating global trade tensions.

Via Talk Markets · June 2, 2025

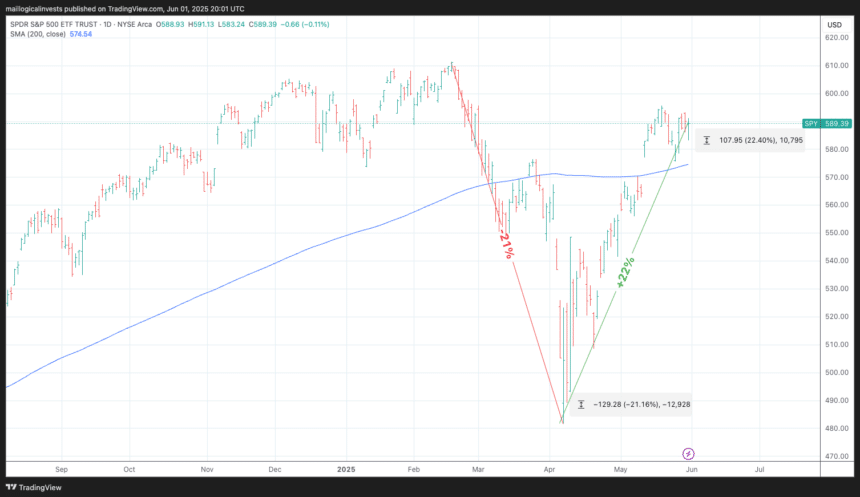

So far this year, the U.S. stock market has experienced a bear market, followed by a recovery.

Via Talk Markets · June 2, 2025

We expect a limited weakening of the zloty and flattening of the yield curve, with lower odds of cuts and higher sovereign risk premium.

Via Talk Markets · June 2, 2025

2025 has certainly kept us on our toes. After falling by 21% in March and April, spreading panic among investors who feared an all-out economic war with China, the S&P 500 staged an impressive rally.

Via Talk Markets · June 2, 2025

After opening on a lower note, Indian benchmark indices pared some gains as the session progressed, ending the day marginally lower.

Via Talk Markets · June 2, 2025

Moderna stock jumped in premarket trading after the FDA granted limited approval for mNEXSPIKE, a new COVID-19 vaccine.

Via Talk Markets · June 2, 2025

On Saturday, OPEC+ announced an increase in oil production of 411,000 barrels per day (bpd) in July.

Via Talk Markets · June 2, 2025

The tariff rollercoaster continues. Most of President Trump’s tariffs were ruled to be outside the scope of the law he used to impose them.

Via Talk Markets · June 2, 2025

Central bank meetings take centre stage with the Bank of Canada on Wednesday and the European Central Bank on Thursday.

Via Talk Markets · June 2, 2025

Personal spending increased +0.2% in April, matching street estimates.

Via Talk Markets · June 2, 2025

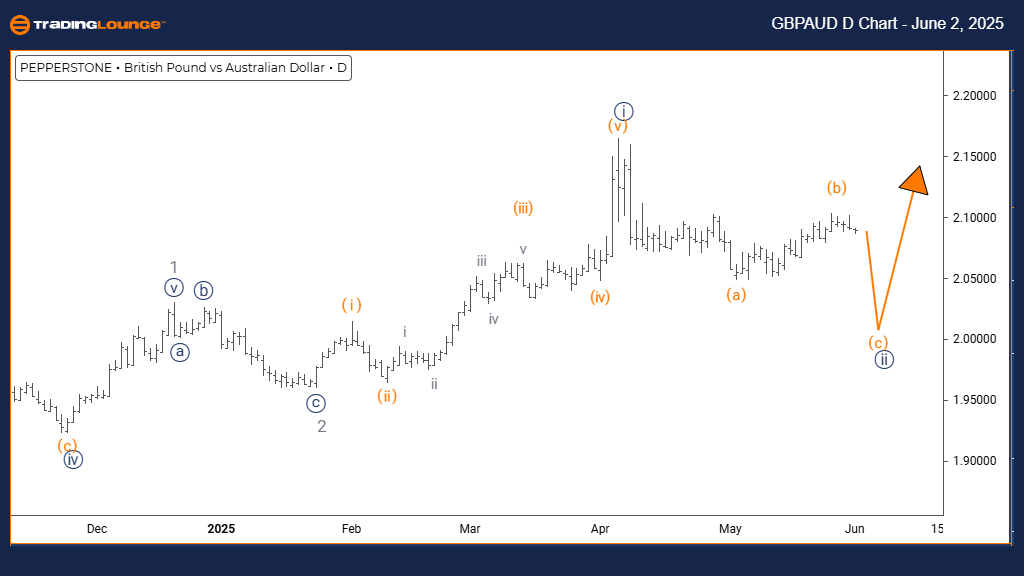

The daily chart for GBPAUD reflects a counter-trend corrective movement within a broader bullish market context.

Via Talk Markets · June 2, 2025

Without rehashing the wild ride we experienced in the market over the last few months (thanks, tariff drama), we experienced a pretty serious melt up since “Liberation Day.”

Via Talk Markets · June 2, 2025

The gold market has been fairly noisy during the month of May, as we continue to see a lot of questions asked about the overall trend in gold.

Via Talk Markets · June 2, 2025

Indian share markets are trading lower today, with the Sensex trading 703 points lower and the Nifty is trading 181 points lower.

Via Talk Markets · June 2, 2025

EUR/GBP holds ground due to dampened risk sentiment after fresh tariff threats from Trump.

Via Talk Markets · June 2, 2025

From a macroeconomic perspective we have numerous dynamics in play.

Via Talk Markets · June 2, 2025

EUR/USD is trading with minor gains on Monday.

Via Talk Markets · June 2, 2025

A shift to a more confrontational stance on trade between the US and China, plus a focus on a potential US 'revenge tax' on foreign investors, are weighing on the dollar.

Via Talk Markets · June 2, 2025

Following the major Wave V bottom at $0.0212, VET/USD advanced to $0.0315 during the sub-wave ⑤.

Via Talk Markets · June 2, 2025

The EUR/USD exchange rate will be in the spotlight this week as the European Central Bank delivers its interest rate decision and as the US publishes its nonfarm payrolls data on Friday.

Via Talk Markets · June 2, 2025

Here are my expectations for upcoming economic data releases.

Via Talk Markets · June 2, 2025

In the US, national security has been cited by proponents of protectionism for a wide variety of products, ranging from computer chips to automobiles to ship building.

Via Talk Markets · June 2, 2025

The new week is a full trading week, may be accompanied by progress on the trading front, and that's possibly the initial take on why we may see the perpetuation of high-range S&P behavior, and selected tickers doing better.

Via Talk Markets · June 2, 2025

At least it’s mercifully less than the 4% that he promised last time (but 9% is more than last time)

Via Talk Markets · June 2, 2025

Traders are parsing China’s factory data like tea leaves—call it a contraction with a silver lining.

Via Talk Markets · June 2, 2025