News

Via The Motley Fool · April 17, 2025

A hawkish Powell failed to lift the dollar yesterday, as the currency market remains heavily focused on risk asset relative performance.

Via Talk Markets · April 17, 2025

What a brutal six months it’s been for Verra Mobility. The stock has dropped 21% and now trades at $21.92, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Via StockStory · April 17, 2025

FXiBot Launches with a Precision Strategy for GBP/USD Trading

Dubai, UAE – 17/04/2025 – ( SeaPRwire ) – FXiBot, the latest innovation in forex automation, introduces a precision-focused strategy designed to master GBP/USD trading with a disciplined, single-position approach. Where overtrading fuels risk and erratic outcomes, this system does the opposite, taking a measured, calculated approach with strategic intent.

Via Binary News Network · April 17, 2025

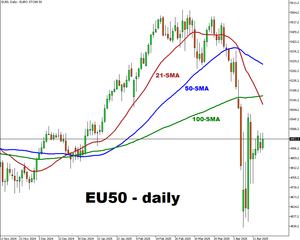

The EU50 index rises on Thursday as investors assess corporate earnings and anticipate a potential rate cut from the European Central Bank.

Via Talk Markets · April 17, 2025

Tariff uncertainty has created an ideal opportunity for long-term investors to pounce.

Via The Motley Fool · April 17, 2025

Via The Motley Fool · April 17, 2025

Google, a part of Alphabet Inc. (NASDAQ: GOOGL) (NASDAQ: GOOG), is confronted with a £5 billion ($6.6 billion) class action lawsuit in the U.K. The company is accused of exploiting its dominant market position in the online search industry.

Via Benzinga · April 17, 2025

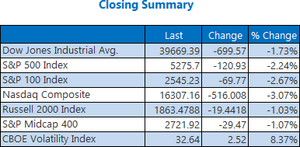

The remarks dragged sentiment across the market, with the S&P 500 and Nasdaq dipping 2.2% and 3.1%, respectively.

Via Stocktwits · April 17, 2025

Well, the good news is: we finished off session lows. The closing bell rang, and we saw another step down in major market indexes, partly due to comments made early this afternoon by Fed Chair Jerome Powell.

Via Talk Markets · April 17, 2025

Abu Dhabi, United Arab Emirates--(Newsfile Corp. - April 17, 2025) - Shory has emerged as a game-changer in the industry...

Via Newsfile · April 17, 2025

In a volatile trading session, the stock market experienced significant declines as Federal Reserve Chair Jerome Powell addressed economic concerns. The S&P 500 fell 2.2% to 5,275.70 points.

Via Benzinga · April 16, 2025

Thursday’s session could see light trading volume due to the “Good Friday” holiday, which could render any move less credible.

Via Stocktwits · April 16, 2025

U.S. stock futures posted modest gains on Wednesday night, recovering from a steep decline in the afternoon session following Federal Reserve chair Jerome Powell's latest comments on the market, tariffs, and inflation.

Via Benzinga · April 16, 2025

Leading cryptocurrencies traded flat on Wednesday as Federal Reserve Chair Jerome Powell’s positive comments regarding the industry.

Via Benzinga · April 16, 2025

The GPIF — the world’s largest pension whale — just dropped a geopolitical bombshell, quietly removing China A-shares from its foreign equity benchmark.

Via Talk Markets · April 16, 2025

The Kohl’s Corporation Companies cut its dividend because of intense competition, inflation, and a stressed customer. Comparable sales are now negative, and tariffs will affect the firm’s results.

Via Talk Markets · April 16, 2025

With the updated debt settlement service from Debt Redemption Texas Debt Relief (832-810-0050), Houston residents can make actionable progress towards living financially free - in as little as 24 to 48 months.

Via Press Release Distribution Service · April 16, 2025

The payment processing solutions company Adaptiv Payments has been operating for over ten years while providing services to businesses belonging to high-risk industries. From its inception, the company has delivered customized financial services to these sectors, including travel, CBD, subscriptions, and e-commerce.

Via AB Newswire · April 16, 2025

Stocks succumbed to Fed rhetoric today, with the Dow retreating back below 40,000 and the Nasdaq shedding over 3%.

Via Talk Markets · April 16, 2025

A number of stocks fell in the afternoon session after Federal Reserve Chair Jerome Powell signaled a cautious stance on future monetary policy decisions during a speech in Chicago, emphasizing that trade tariffs could add upward pressure to inflation in the short term and complicate the Fed's efforts to stabilize the economy. He warned that such trade measures are "likely to move us further away from our goals," referring to the Fed's dual mandate of price stability and maximum employment.

Via StockStory · April 16, 2025