Latest News

Via The Motley Fool · April 17, 2025

Via The Motley Fool · April 17, 2025

There are some excellent opportunities for long-term investors right now.

Via The Motley Fool · April 17, 2025

These fast-growing tech companies are executing well, yet an investment in their shares may not make sense.

Via The Motley Fool · April 17, 2025

Via The Motley Fool · April 17, 2025

Shareholders of Distribution Solutions would probably like to forget the past six months even happened. The stock dropped 34.1% and now trades at $26.44. This might have investors contemplating their next move.

Via StockStory · April 17, 2025

What a brutal six months it’s been for Verra Mobility. The stock has dropped 21% and now trades at $21.92, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Via StockStory · April 17, 2025

Even during a down period for the markets, Life Time has gone against the grain, climbing to $31.72. Its shares have yielded a 25.7% return over the last six months, beating the S&P 500 by 34.7%. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Via StockStory · April 17, 2025

Yext trades at $6.11 per share and has moved almost in lockstep with the market over the last six months. The stock has lost 13.9% while the S&P 500 is down 8.9%. This might have investors contemplating their next move.

Via StockStory · April 17, 2025

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Merit Medical Systems (NASDAQ:MMSI) and the rest of the medical devices & supplies - cardiology, neurology, vascular stocks fared in Q4.

Via StockStory · April 17, 2025

Hormel Foods has been treading water for the past six months, recording a small loss of 4.3% while holding steady at $30.21.

Via StockStory · April 17, 2025

Avis Budget Group trades at $75.35 per share and has stayed right on track with the overall market, losing 6.1% over the last six months while the S&P 500 is down 9%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Via StockStory · April 17, 2025

Since April 2020, the S&P 500 has delivered a total return of 85%. But one standout stock has more than doubled the market - over the past five years, Astronics has surged 197% to $24 per share. Its momentum hasn’t stopped as it’s also gained 14.1% in the last six months thanks to its solid quarterly results, beating the S&P by 23%.

Via StockStory · April 17, 2025

Over the past six months, BWX’s shares (currently trading at $104.17) have posted a disappointing 16.7% loss while the S&P 500 was down 8.9%. This might have investors contemplating their next move.

Via StockStory · April 17, 2025

You might be surprised at how much of a difference waiting can make.

Via The Motley Fool · April 17, 2025

Let’s dig into the relative performance of Hims & Hers Health (NYSE:HIMS) and its peers as we unravel the now-completed Q4 healthcare technology earnings season.

Via StockStory · April 17, 2025

Via The Motley Fool · April 17, 2025

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the data storage stocks, including MongoDB (NASDAQ:MDB) and its peers.

Via StockStory · April 17, 2025

Plug Power's growth has been impressive but is the company hitting a wall?

Via The Motley Fool · April 17, 2025

Via The Motley Fool · April 17, 2025

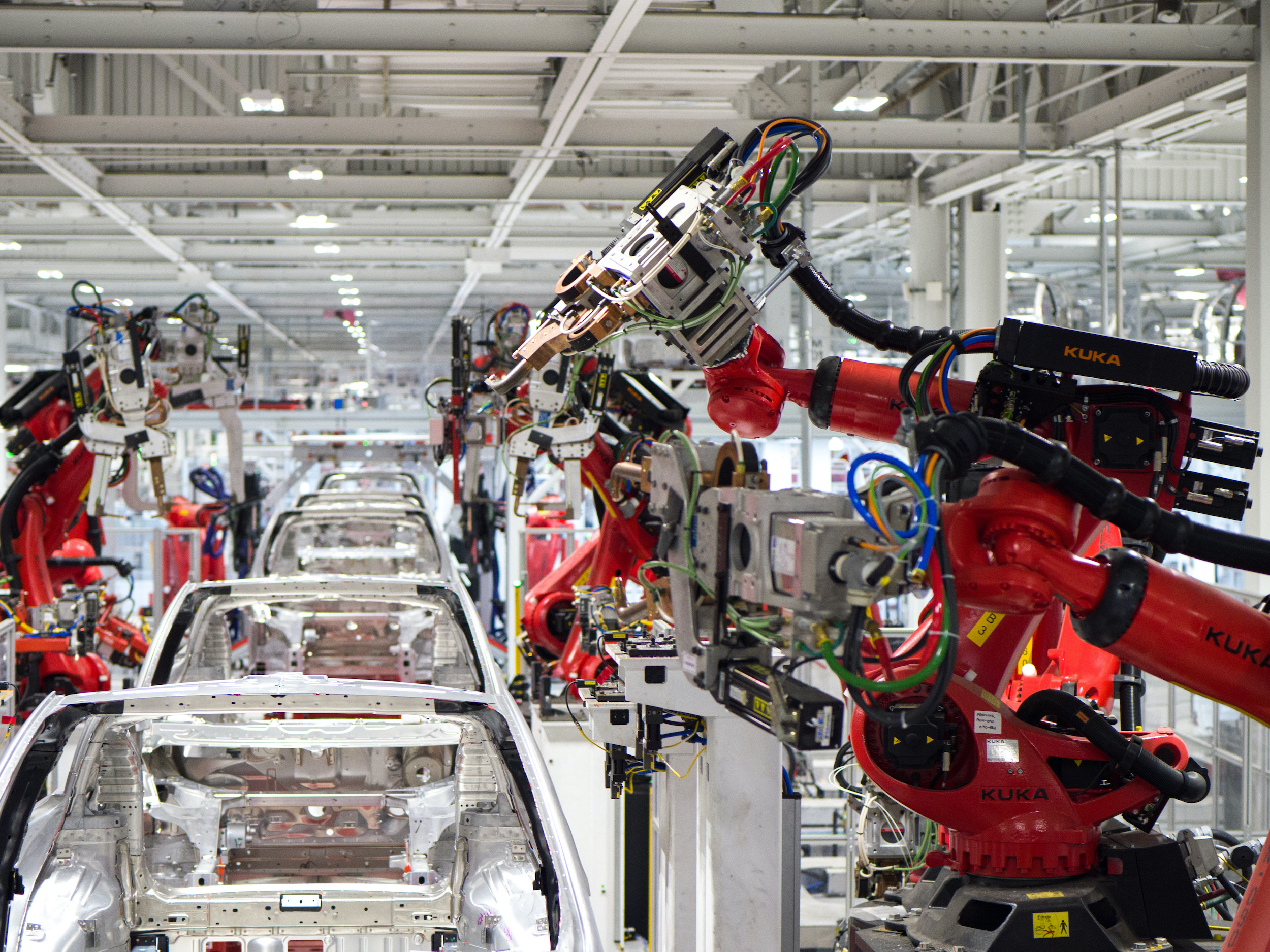

The electric car maker's shares have fallen sharply this year. But have they declined enough to make the stock a buy?

Via The Motley Fool · April 17, 2025

Via The Motley Fool · April 17, 2025

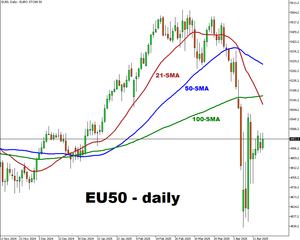

The EU50 index rises on Thursday as investors assess corporate earnings and anticipate a potential rate cut from the European Central Bank.

Via Talk Markets · April 17, 2025